Imagine sitting down for a check-up with your doctor. They hand you a 50-page printout filled with jargon, charts you don’t recognize, and numbers that mean nothing without context. Would you feel informed? Trusting? Or just confused and anxious?

That’s exactly how most high-net-worth (HNW) clients feel when they receive a dense, boiler-plate financial statement. For too long, wealth management reporting has been treated as a compliance chore, A necessary evil to meet regulatory deadlines.

But here’s the secret: Reporting isn’t a chore; it’s your most powerful client retention tool.

The modern client doesn’t just want data; they want a story. They want to know, “Am I okay? Am I on track? What’s next?” If your reports don’t answer those three questions clearly, you’re leaving the door open for a competitor who can.

This guide is your deep-dive into transforming your reporting process. We’re moving past PDFs and Excel exports and into a world of hyper-personalized, insightful reporting that strengthens client relationships and justifies your fees.

The Unspoken Truth: Why Reporting Is the Core of Client Trust

We live in a low-trust environment. Clients, especially those managing generational wealth across various institutions, are more skeptical than ever. Your annual or quarterly report is not just a summary of performance; it’s a tangible representation of your value proposition.

If that report is confusing, late, or generic, the client subtly questions your competence.

Defining the Modern Wealth Report: More Than Just Numbers

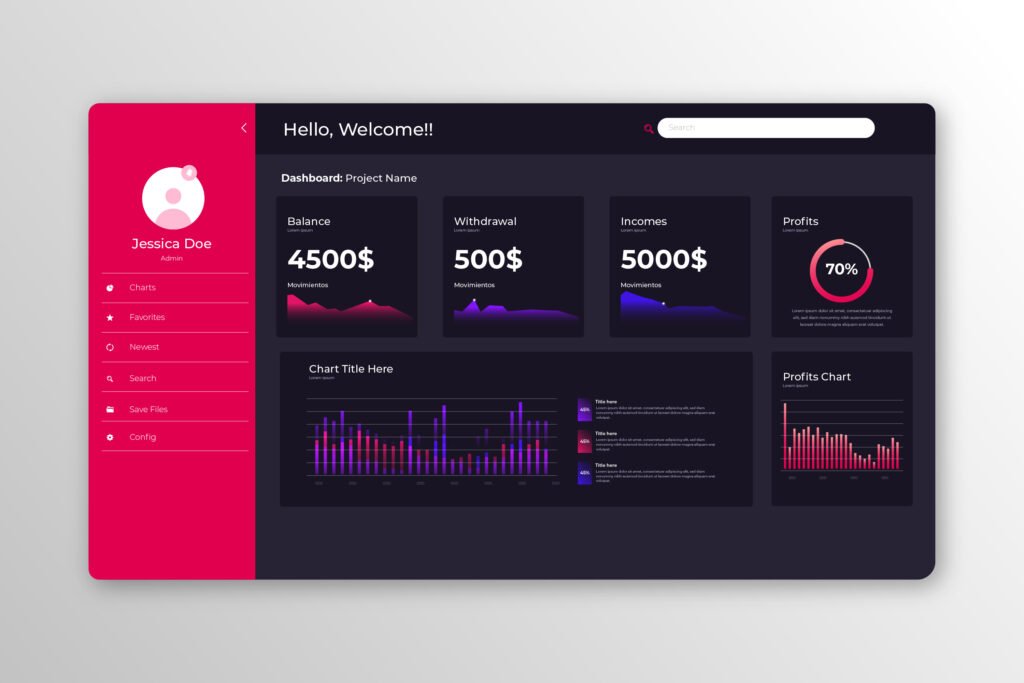

What defines modern wealth management reporting? It’s simplicity overlaid on complexity. It must provide a 30,000-foot view of the entire financial universe, private equity, real estate, multiple brokerage accounts—while also allowing the client to instantly zoom in on a specific position’s performance.

It’s about aggregation and synthesis. A good report unifies disparate data sources. A great report explains what that unified data means for the client’s life goals.

Shifting From Data Dump to Client Storytelling

Stop presenting data. Start presenting a narrative.

Think of it like a professional sports analyst. They don’t just show the final score (the return). They break down the game: “Here’s how our defense (bonds) protected against volatility in Q2, allowing our offense (tech stocks) to capitalize on the rally. We executed the plan.”

Example: Instead of a line item that simply shows “2.4% YTD Return,” the report narrative should say: “Despite significant market volatility, the conservative allocation to fixed income stabilized the portfolio. Your active management allocation (The Aggressive Basket) outperformed its benchmark by 1.1%, putting you precisely on track for the projected tuition funding goal in 2030.”

This small shift takes the focus off market performance (which you can’t control) and places it squarely on plan execution (which you can).

Pro Tip: Measuring Client Engagement With Your Reports

How do you know if your reporting is working? You measure it.

If you’re using a digital client portal, track these metrics:

Time Spent: How long do clients spend viewing the report? (More time means they are engaging, not just glancing.)

Section Clicks: Which specific sections (e.g., performance attribution, fees) do they click on most? This tells you what they actually care about.

PDF Downloads: A low download rate suggests they are happy viewing the dynamic, online version, which is better for real-time engagement.

The Essential Checklist: 4 Reports Every HNW Client Needs

The best wealth management reporting systems provide customizable dashboards, but there are four essential types of reports that form the backbone of a successful client relationship. These are the core information pieces that every advisor needs to master.

The Performance Deep Dive (Time-Weighted vs. Money-Weighted Returns)

This is the most critical and often most confusing section. You need to clearly distinguish between two things:

Time-Weighted Return (TWR): Measures the return generated by the manager’s skill, eliminating the effect of client deposits or withdrawals. This is the scorecard for the advisor.

Money-Weighted Return (MWR): Measures the return the client actually earned on their investment, factoring in all cash flows. This is the scorecard for the client.

Lived-in Advice: Always show both, but lead the conversation with MWR. The client cares about the cash in their pocket. Use TWR internally and in the attribution section to demonstrate your management skill.

2. True Asset Allocation & Look-Through Reporting (Seeing the Whole Picture)

When a client holds a stake in a private equity fund, an SMA, and a public brokerage account, saying their allocation is “40% Alternatives” is useless. They need look-through reporting.

This means drilling down into every pooled investment vehicle (like mutual funds or private funds) to see the underlying assets. Only then can you truly say, “Your total exposure to U.S. technology stocks across all three accounts is 12%,” which is the only figure that matters for risk management.

Long-Tail Opportunity: This is where advanced reporting software earns its price tag by automating the complex aggregation necessary for true look-through reporting.

3. Tax-Aware & Fiduciary Reporting (Staying Compliant and Smart)

Clients don’t want to be surprised by their tax bill. Reports must integrate tax implications throughout the year, not just at year-end. This involves:

Realized/Unrealized Gains and Losses: A running tally that allows for timely tax-loss harvesting.

Cost Basis Tracking: Accurate, consistent tracking across all custodians.

Fiduciary Compliance Summary: A brief statement showing how the report and portfolio actions align with the client’s stated goals and the regulatory standards (e.g., Reg BI in the US).

4. The Cash Flow & Liquidity Analysis (The Day-to-Day View)

For retirees or clients planning major purchases, the most important metric isn’t the total market value; it’s the runway. A good report provides a clear projection: “Based on your current withdrawal rate, your portfolio has a projected solvency period of 28 years with a 90% confidence level.”

This report takes the stress out of withdrawals and transitions the conversation from market volatility to long-term sustainability.

Aggregation Headache: The Biggest Challenge in Wealth Reporting

Even with the best intentions, the process of creating a holistic report hits a massive wall: data aggregation.

The Multi-Custodian Nightmare (Unifying Data From 3+ Sources)

For the ultra-high-net-worth client, their wealth is often scattered: a Swiss bank account, a U.S. brokerage, a private real estate partnership, and a family trust held elsewhere. These systems don’t talk to each other.

Advisors face two main manual hurdles here:

Normalization: Converting different data formats (e.g., one custodian calls it ‘Fixed Income,’ another calls it ‘Bonds’) into a single classification scheme.

Frequency: Getting timely data feeds from slow or legacy systems, which delays quarterly reporting and makes real-time views impossible.

Analogy: Trying to aggregate data from multiple custodians using spreadsheets is like building a skyscraper using only handwritten notes. It’s slow, prone to error, and collapses under its own weight.

Data Security and Privacy (Protecting the Golden Records)

When you pull all a client’s financial information into one place, you create a single, highly valuable target for cybercriminals.

Pro Tip: Your reporting solution isn’t just a number-cruncher; it’s a vault. Ensure any third-party software meets SOC 2 compliance standards and uses end-to-end encryption. The weakest link is often the email—never send unprotected reports via standard email; use a secure, two-factor authenticated client portal.

The Human Factor: Training and Error Reduction

The biggest cause of reporting error isn’t the software; it’s the person using it. A complex reporting system requires dedicated training for staff to understand the inputs and validation rules.

A mistake in classifying an alternative investment can throw off the entire asset allocation.

A failure to reconcile a corporate action can lead to inflated performance figures.

This is why simplicity in the user interface (UI) of the reporting software is critical. A system that is easy for the advisor to operate minimizes errors, which ultimately protects the relationship.

Beyond the Spreadsheet: Choosing the Best Reporting Software

The “best” solution isn’t the most expensive; it’s the one that solves your firm’s unique aggregation and communication problems. The shift from manual assembly to automated wealth management reporting platforms is now non-negotiable for scaling firms.

Key Feature Showdown: What to Look For

Feature

Why It MattersData Automation

Pulls clean data directly from custodians, eliminating manual entry.Customization

Allows you to brand reports and tailor specific metric views for individual clients (HNW reporting).Mobile Access

A high-quality, reliable client-facing mobile app is mandatory for engagement.Performance Attribution

Shows why you got the return you did (e.g., sector selection, currency impact), not just what the return was.

Software Comparison: Proprietary Systems vs. Third-Party Aggregators

You generally have two paths:

Proprietary Systems: Built-in reporting tools offered by large broker-dealers or custodians. They are great for simple, single-custodian accounts but struggle significantly with outside assets.

Third-Party Aggregators (e.g., Addepar, Masttro, specialized solutions): These platforms are purpose-built to pull, cleanse, and normalize data from hundreds of sources (custodial banks, general ledgers, private fund administrators). They offer superior custom reporting but require a separate licensing fee and integration work.

For firms with complex HNW clients, the latter is the necessary infrastructure to provide true consolidated wealth management reporting.

The Cost vs. Value Equation (When Is the ROI Worth the Price?)

Reporting software is not cheap. But calculate the true cost of manual reporting:

Staff Time: How many hours does an analyst spend copying, pasting, and formatting data quarterly?

Error Risk: What is the cost of losing a $10M client due to a reporting mistake or a late report?

A system that frees up a high-level employee for 20 hours a quarter, prevents even a single error, and boosts client trust easily pays for itself. The ROI isn’t just measured in efficiency; it’s measured in client retention.

The Future of Reporting: AI, Personalization, and the Next Decade

The next leap in wealth management reporting isn’t about better charts; it’s about anticipating the client’s needs. The future is predictive and deeply personal.

Predictive Analytics: Answering Questions Before They’re Asked

Imagine a report that doesn’t just show the current tax liability but alerts the client: “Based on current portfolio trajectory and projected income, we recommend a $50k tax-loss harvest in the next 30 days to optimize your Q4 tax payment.”

This uses AI to scan market data against client goals and generates timely, actionable insights, elevating the advisor from a money manager to a proactive financial partner.

Hyper-Personalization: Reports That Feel Custom-Made

Why should a 40-year-old tech entrepreneur saving for liquidity receive the same report template as an 80-year-old philanthropist drawing down capital?

Future reporting platforms will allow clients to select their preferred view. One client might want the report dominated by ESG metrics; another might focus entirely on risk-adjusted returns. The technology delivers one unified data set, presented in 100 different client-specific formats.

Regulating the Future: Navigating New Compliance Horizons

As wealth goes global, reporting must keep pace with international regulations (like MiFID II in Europe or new disclosure rules). Future reporting systems must be flexible enough to handle multiple jurisdictional standards simultaneously, making global compliance an integrated feature, not an operational burden.

Final Takeaway: Turning Reports Into Relationship Builders

Wealth management is fundamentally about trust, and trust is built on transparency and communication. Your wealth management reporting system is the mechanism by which you deliver both.

Stop letting generic reports sabotage your hard work. Invest in systems that aggregate complex data smoothly, deliver clear, narrative-driven insights, and allow your clients to engage with their wealth on their terms.

Do this, and you won’t just manage portfolios; you’ll build relationships that last generations.